Bad credit debt consolidation loans provide UK residents with a way to manage multiple high-interest debts by combining them into one lower-rate loan, simplifying repayment and saving money. Despite the name, individuals with poor credit can still qualify based on individual factors. To secure the best rates, compare lenders, improve your credit score before applying, and demonstrate responsible borrowing habits through timely repayments.

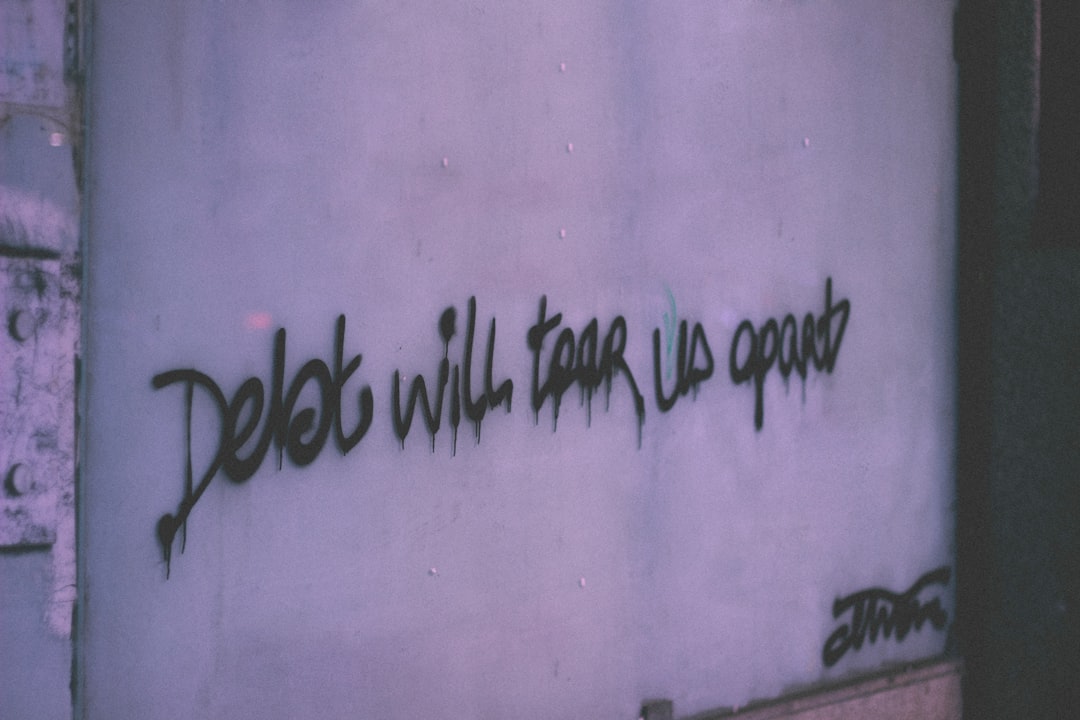

In today’s financial landscape, managing multiple debts can be a complex challenge, especially for those with bad credit. However, a solution exists through Bad Credit Debt Consolidation Loans in the UK. These loans offer an opportunity to streamline payments and reduce interest costs. Understanding this process is key to making informed decisions. This article guides you through the intricacies of Bad Credit Debt Consolidation Loans, focusing on how to secure competitive interest rates that could save you money and simplify your financial journey.

- Understanding Bad Credit Debt Consolidation Loans in the UK

- How to Secure Competitive Interest Rates for Your Loan

Understanding Bad Credit Debt Consolidation Loans in the UK

Bad credit debt consolidation loans are designed to help individuals in the UK who are burdened by multiple high-interest debts. These loans allow borrowers to consolidate their debts into a single loan with a lower interest rate, making it easier to manage their repayments and potentially save money. In the UK, such loans come with competitive interest rates, which can make them an attractive option for those struggling with debt.

When considering bad credit debt consolidation loans, it’s crucial to understand that lenders will assess your creditworthiness based on factors like your credit history, current financial situation, and the amount of debt you’re looking to consolidate. Despite the name, these loans aren’t necessarily off-limits for individuals with poor credit; they are evaluated on a case-by-case basis. It’s essential to shop around for lenders offering competitive rates and transparent terms to ensure you get the best deal possible.

How to Secure Competitive Interest Rates for Your Loan

Securing competitive interest rates for a bad credit debt consolidation loan involves a few strategic steps. First, compare multiple lenders and their offered rates. Look beyond just the number; consider the terms and conditions attached to each loan proposal. Lenders with lower interest rates might have stricter criteria or charge hidden fees that could offset the initial savings.

Second, your credit score plays a significant role in determining interest rates. While bad credit debt consolidation loans are designed for those with less-than-perfect credit, improving your score before applying can lead to better terms. Regularly review your credit report for errors and work on correcting them. Additionally, timely loan repayments demonstrate responsible borrowing habits, which lenders often reward with more favourable interest rates.

Bad credit debt consolidation loans can be a powerful tool for managing financial obligations. By securing competitive interest rates, individuals with less-than-perfect credit histories can streamline their debts and take control of their finances. Understanding these loans and how to access the best rates available is key to achieving long-term financial stability and peace of mind in the UK.