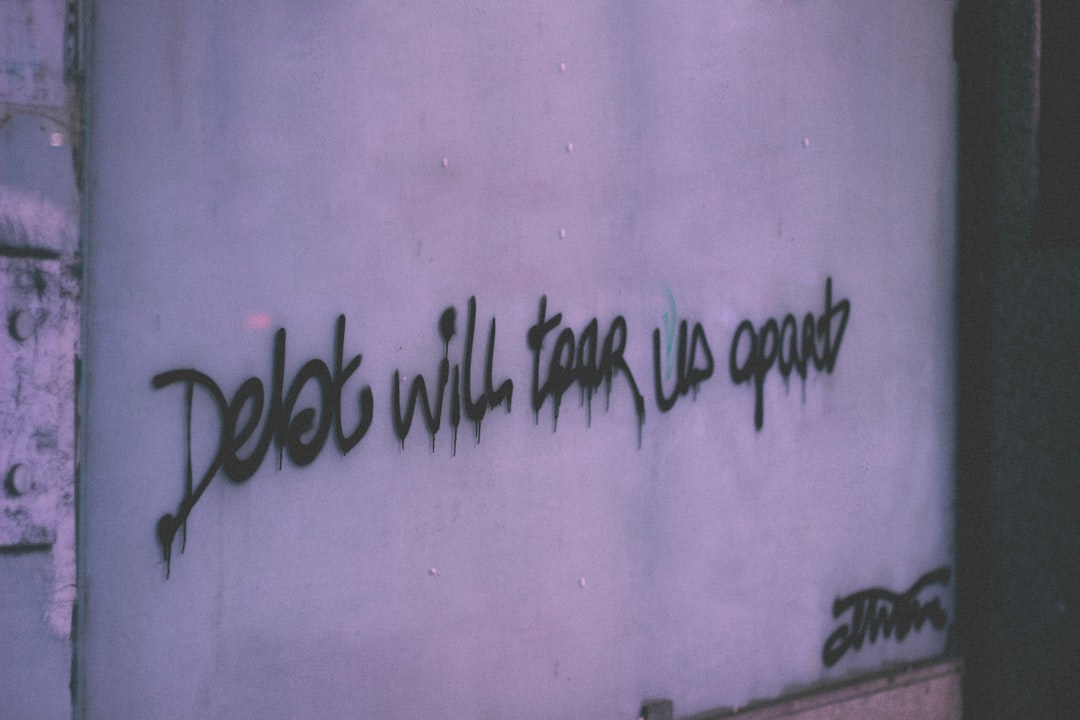

Bad Credit Debt Consolidation Loans provide a way out for those with high-interest, multiple debts, offering lower rates and simplified repayment terms. However, careful consideration of loan terms, including interest rates, repayment periods, and fees, is crucial to avoid hidden costs. Borrowers should also research lender reputation and services while understanding the risks involved, as these loans don't solve spending issues; alternative options like credit counseling may be beneficial.

Considering a bad credit debt consolidation loan? This guide helps you navigate this option effectively. We break down the essentials, from understanding what these loans are and how they work, to evaluating crucial terms like interest rates, repayment periods, and fees. Learn key factors to consider when comparing lenders, as well as the benefits and risks involved. Make an informed decision with our comprehensive overview on bad credit debt consolidation loans.

- Understanding Bad Credit Debt Consolidation Loans: What They Are and How They Work

- Evaluating Loan Terms: Interest Rates, Repayment Periods, and Fees

- Comparing Lenders: Factors to Consider When Choosing a Debt Consolidation Loan Provider

- Benefits and Risks: Weighing the Pros and Cons of Debt Consolidation for Bad Credit Borrowers

Understanding Bad Credit Debt Consolidation Loans: What They Are and How They Work

Bad Credit Debt Consolidation Loans are designed for individuals with low or fair credit scores who are burdened by multiple high-interest debts. These loans offer a unique opportunity to streamline and simplify debt repayment by combining several outstanding debts into one single loan with a significantly lower interest rate. The primary goal is to help borrowers save money on interest charges and make their debt management process more manageable.

This type of consolidation loan allows borrowers to refinance their existing debts, often including credit card balances, personal loans, or even past-due bills. The lender provides a new loan with a lower interest rate, paying off the original debts. Borrowers then focus on repaying the consolidation loan over an agreed-upon period, typically 3–5 years. By consolidating, borrowers can say goodbye to multiple monthly payments and reduce their overall debt burden.

Evaluating Loan Terms: Interest Rates, Repayment Periods, and Fees

When comparing low-interest debt consolidation loans, a critical aspect is evaluating the loan terms. Interest rates play a significant role in determining the overall cost of borrowing. Opting for a lower interest rate can save a substantial amount over the life of the loan, especially for those with bad credit who often face higher rates. It’s essential to consider both fixed and variable interest rates, as they impact monthly payments and the total repayable amount differently.

Repayment periods also vary among lenders, offering terms ranging from several years to decades. Shorter repayment periods typically result in higher monthly installments but lessen the overall interest paid. On the other hand, extended periods lower monthly burdens but extend the time to repay, increasing the cumulative interest expenses. Additionally, fees are a crucial consideration. Some lenders charge origination or processing fees, while others may have prepayment penalties or require collateral. Understanding these fee structures ensures borrowers know all associated costs before securing a Bad Credit Debt Consolidation Loan.

Comparing Lenders: Factors to Consider When Choosing a Debt Consolidation Loan Provider

When comparing lenders for a bad credit debt consolidation loan, it’s crucial to look beyond interest rates and loan terms. Factors like lender reputation, customer service, and additional services can significantly impact your overall experience and financial health. Researching each lender’s history and reading reviews from previous customers can provide insights into their reliability and integrity.

Consider the types of loans offered, flexibility in repayment options, and any hidden fees or charges. Some lenders specialize in bad credit debt consolidation, having tailored programs to accommodate borrowers with less-than-perfect credit. Look for providers who offer educational resources and financial guidance, as these can empower you to manage your debt more effectively and make informed decisions about your finances.

Benefits and Risks: Weighing the Pros and Cons of Debt Consolidation for Bad Credit Borrowers

Debt consolidation can be a powerful tool for individuals with bad credit, offering several potential advantages. By consolidating high-interest debts into a single loan with a lower interest rate, borrowers can save money on interest payments and simplify their repayment process. This strategy can help improve cash flow, making it easier to manage monthly expenses. Furthermore, a good debt consolidation loan can positively impact credit scores over time by reducing debt and promoting responsible financial behavior.

However, there are risks associated with bad credit debt consolidation loans. Lenders may charge higher interest rates or require significant collateral, such as a house or car, increasing the potential for financial strain if the borrower defaults. Additionally, consolidating debts might not address the root causes of overspending or poor borrowing habits, which could lead to future financial difficulties. Borrowers should carefully consider their ability to repay the loan and explore alternative solutions, like credit counseling, before committing to a debt consolidation plan.

When considering bad credit debt consolidation loans, a thorough comparison of lenders and loan terms is essential. By evaluating interest rates, repayment periods, fees, and the lender’s reputation, borrowers can make an informed decision that suits their financial needs. Understanding both the benefits and risks involved allows individuals to navigate this option with confidence, potentially leading to improved financial health and a clearer path towards debt freedom.